emv skimmers: A Growing Threat to Cardholder Security – How to Stay Safe and Aware

As technology advances, so do the methods used by criminals to commit fraud and steal sensitive information. One such method that has gained significant attention is the use of EMV skimmers. EMV, which stands for Europay, Mastercard, and Visa, is the global standard for chip-based payment cards aimed at increasing security. However, even with this enhanced security, EMV skimmers pose a growing threat to cardholder security.

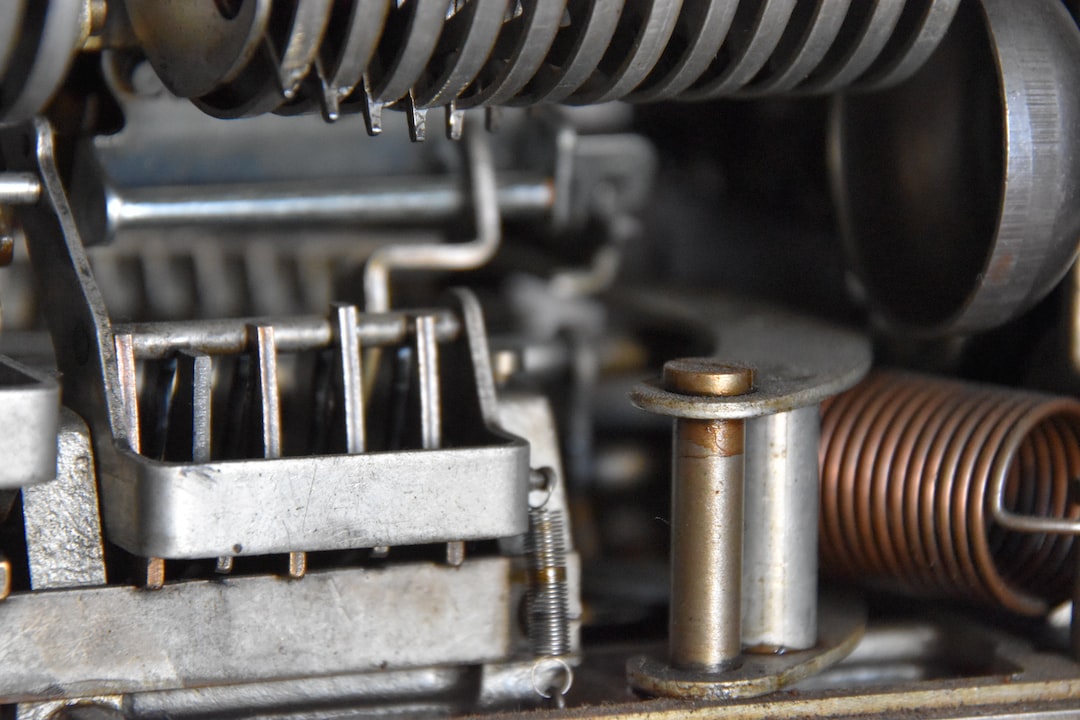

EMV skimmers are sophisticated devices that can be installed on ATMs, gas pumps, or payment terminals, designed to steal the information stored on your EMV chip card. These skimmers are virtually undetectable to the untrained eye, making it challenging for cardholders to identify if they are using a compromised machine. Once the skimmer captures your card information, criminals can create counterfeit cards or sell the data on the black market, leading to financial loss and identity theft.

To stay safe and aware in this era of EMV skimmers, there are several precautions cardholders should take. Firstly, it is essential to inspect the payment terminal or ATM before using it. Look for any signs of tampering, such as loose or mismatched components, unusual overlays on the keypad, or suspicious devices attached to the card slot. If something seems off, refrain from using the machine and report it.

Using contactless payment methods, like mobile wallets or tap-to-pay cards, can also provide an added layer of security against EMV skimmers. These payment options use tokenization, a process that replaces sensitive card data with a unique token, preventing the interception of card information by skimmers. By using contactless payments, you minimize the risk of falling victim to skimming attacks.

Another vital precaution to consider is monitoring your account activity regularly. Frequently review your banking statements and credit card transactions for any suspicious or unauthorized charges. If you notice anything unusual, report it immediately to your bank or card issuer. The quicker you act, the better chance you have of mitigating the potential damages caused by an EMV skimmer.

In addition to these preventive measures, it is also important to be aware of the latest trends and developments in card skimming techniques. Stay informed about the latest news and alerts from financial institutions and law enforcement agencies regarding new skimming tactics. By staying updated, you can take appropriate measures to safeguard your information and avoid falling victim to EMV skimmers.

In conclusion, EMV skimmers pose a significant threat to cardholder security, despite the enhanced security features of chip-based cards. To stay safe and aware, it is crucial to inspect payment terminals for signs of tampering, consider using contactless payments, monitor your account regularly, and stay informed about the latest skimming techniques. By taking these precautions, you can protect yourself against the growing threat of EMV skimmers and ensure the security of your financial information.

——————-

Article posted by:

ILLUMINATI OFFICIAL

https://www.illuminatiofficialswebsite.org/